Why is Futures trading superior to other markets:

- Really low commissions;

- You can turn a fast profit;

- Lots of options for diversification;

- Markets are liquid;

- Easy to get into;

- There is no time decay;

- Fixed upfront trading fees.

Futures trading revolves around the buying and selling of standardized contracts, known as futures contracts, at predetermined prices set today for delivery on a future date. These contracts can be based on various assets, including commodities, financial instruments, or cryptocurrencies.

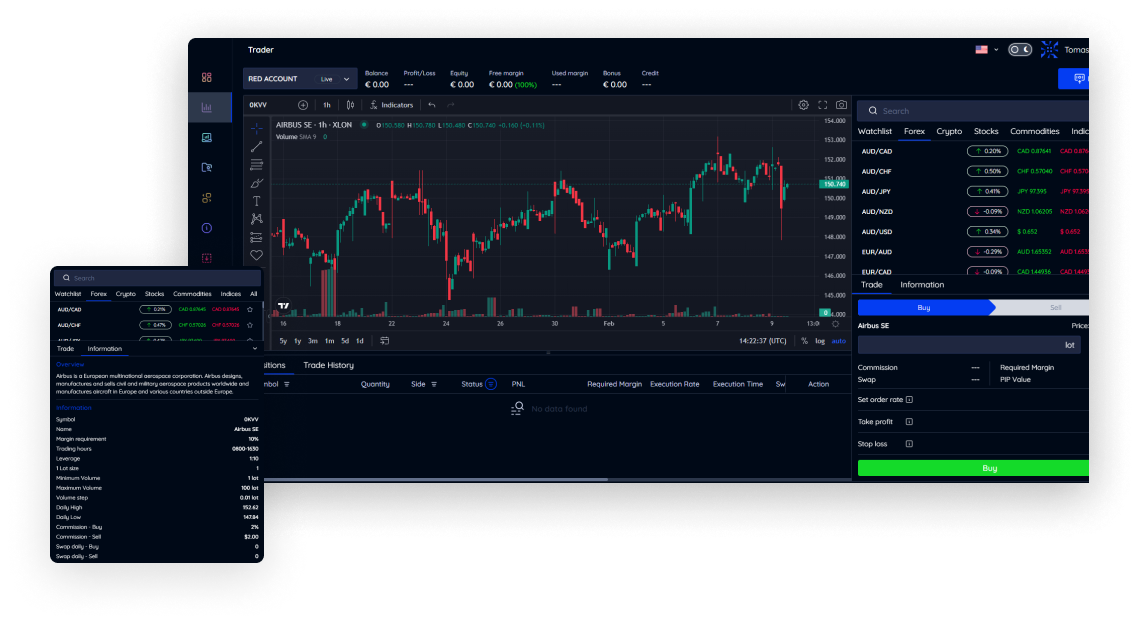

Try trading now

To comprehend what futures trading entails, you must first comprehend what derivatives trading entails.

Derivatives are financial contracts whose value is based on the movement of the price of another financial item. A derivative’s price is linked to the price of the asset from which it derives its value.

A futures contract is an agreement between a buyer (with a long position) and a seller (with a short position) in which the buyer commits to buy a derivative or index at a fixed price at a future date.

The contract’s price changes over time in relation to the fixed price at which the transaction was made, resulting in a profit or loss for the trader. We’re here for the profit.